Tourism taxes are becoming increasingly popular around the world as a means of combating overtourism and funding sustainable tourism practices. Although the effectiveness of these taxes in combating climate change is still debated, the growing popularity of tourism taxes reflects growing awareness of the need for sustainable tourism.

Climate change is having a major impact on the world around us, including how people travel and the destinations themselves. Green Travel is a seven-part series that delves into how climate change is changing the travel landscape.

Travelers hoping to explore ancient ruins or relax on beaches with some of the world’s bluest waters will face a new tax in Greece. Unlike visa fees and general consumption taxes, this fee is specifically aimed at addressing climate change.

Earlier this year, the Mediterranean country announced it would introduce a new accommodation tax called the “Climate Resilience Fee.” The tax only applies during the peak travel season from March to October. Once enacted, the tax will be almost double the previous lodging tax.

Taxes are payable at check-in and vary depending on the level of accommodation selected, starting at €1.50 (approximately $1.64) per night for apartments and one- and two-star hotels. It can cost up to 10 euros (approximately $10.96). A night at a five-star hotel.

Hawaii’s beaches are disappearing: the uncertain future of Oahu’s iconic Waikiki

Enjoy your vacation with peace of mind: the best travel insurance

The new tax is expected to bring in about 300 million euros ($329 million) in revenue this year as tourism to Greece peaked this summer. The money will fund recovery efforts after last year’s heatwave, deadly bushfires and the worst extreme floods on record. It is also expected to contribute to other environmental initiatives related to climate resilience.

Greece’s new tax is one of many tourism taxes being introduced around the world to combat climate change and overtourism. Taxes place a responsibility on travelers to protect the very destinations they enjoy. Travelers should expect these fees to continue as sustainable destination management becomes more important in many places.

“Many cities are recognizing the need for sustainable tourism practices, leading to tax increases to fund necessary initiatives,” says the New York University School of Professional Studies, Tisch Hospitality Institute. said Anna Abelson, a professor who specializes in tourism.

Here’s everything travelers need to know about tourism taxes.

Will we see green skies by 2050? About airline eco-goals

What is a tourist tax? Why is it becoming more popular?

Over the past 20 years, every destination in the world has imposed some type of tax on tourists, Abelson said. Most of the funding was allocated to address the economic impact of tourism, but as these places feel the strain, the focus has shifted to destination management.

Greece, New Zealand, Bali, Amsterdam, Venice and Iceland are just some of the places that have increased or introduced tourism taxes in 2024 alone. Earlier this year, Hawaii proposed a $25 climate tax to be paid by its 9.5 million annual visitors. If passed, it would have been the first state in the U.S. to enact such a tax. Estimated to have generated $68 million a year in revenue, the tax would have funded coral reef restoration, green infrastructure, and wildfire and flood prevention.

According to Chris Inbsen, vice president of research for sustainability and the world, these fees serve several purposes. They say it could be to reduce the number of tourists, curtail short-term visits so travelers spend more in the local economy, or as a financing mechanism for a variety of initiatives. Travel and Tourism Council.

Conversely, prices can also unfairly value low-income travelers. Since 2022, Bhutan has been charging travelers a hefty “sustainable development fee” of $200 per person per day. On September 10, the Galapagos Islands, considered to be rich in wildlife, doubled its $100 per person admission fee to $200 for trips of up to 50 days. This is the first price increase in 26 years.

Paulina Burbano de Lara, CEO of Metropolitan Touring, a provider of land and cruise expeditions to the Galapagos Islands, said: “For us, the price increase is a sign of the Ecuadorian government’s commitment to the long-term conservation of the Galapagos Islands.” “This reflects our proactive efforts.” In a news release. “We see this as an effort to protect the islands’ fragile and unique ecosystems and benefit future generations.”

Alaska’s glaciers are melting: What’s happening to Alaska’s glaciers and how it will affect your trip

How do travelers pay the tourist tax?

These taxes are typically administered by local or central governments and collected in a variety of ways, including at hotels and at airport and port entrances.

Iceland reinstated its tourism tax earlier this year after it was suspended due to the pandemic, charging hotel guests 600 ISK (about $4.42) and cruise passengers 1,000 ISK (about $7.36). On February 14, Bali will start charging foreign travelers 150,000 rupiah (about $9.56), which can be paid before travel or at immigration at the airport. Amsterdam has raised its tourism tax to 21.80 euros (about $23.88) per day for hotel guests and 11 euros ($12.05) per person per day for cruise passengers. Venice made headlines after it trialled a 5 euro (about $5.48) fee for day trippers on peak summer days. Travelers had to “book” their slots online and show a QR code if stopped by authorities, but in July Lagoon City announced it would update its prices and increase them in 2025.

Where will the money go?

In most cases, like Bali and Iceland, tax revenue is said to fund efforts to protect and conserve the environment, preserve cultural heritage, and improve infrastructure, Abelson said.

These efforts resonate with the fact that 71% of travelers want to “leave the places they visit better than when they arrived,” according to Booking.com’s 2024 Sustainable Travel Research Report. There may be.

For some countries, like New Zealand, which publishes an annual report on the allocation of IVL funding, it is difficult to see where the proceeds go, such as recovering endangered birds or building the capacity of conservation law enforcement agencies. It’s easy to track exactly where they are. For others, it’s not so clear.

“Transparency in how funds are allocated can increase trust and encourage responsible tourism behavior. When travelers understand transparency in reporting how tax revenue is used, it increases their support and participation. “It can be encouraged,” Abelson said.

For example, in 2016 Mallorca introduced a sustainable tourism tax of several euros per night on all stays in tourist accommodation, with revenue linked to investments in sustainable tourism and climate change. The money will be used to fund scientific research projects and other initiatives. But Inbsen said finding details and reports on tax successes is inaccessible, or at least very difficult to find.

Regardless of whether travelers are able to find out the status of their paid taxes, these fees will not go away. In fact, as the weather becomes more severe and sea levels continue to rise, travel is expected to become even more expensive. “Prices are likely to rise to address environmental degradation,” Inbsen said.

Are they effective?

That’s the big question. “The jury is out on its effectiveness,” Inbsen said.

Abelson agreed, adding: “It depends on the outcome.” In some places, tourism tax revenues have been shown to be used to fund several projects that benefit local communities and the environment. Italy’s Lake Como has earmarked 348,000 euros (approximately $383,931) of tourism tax revenue for the first half of 2024 to collect the city’s organic waste, maintain its shores and restore frescoes in its historic centre.

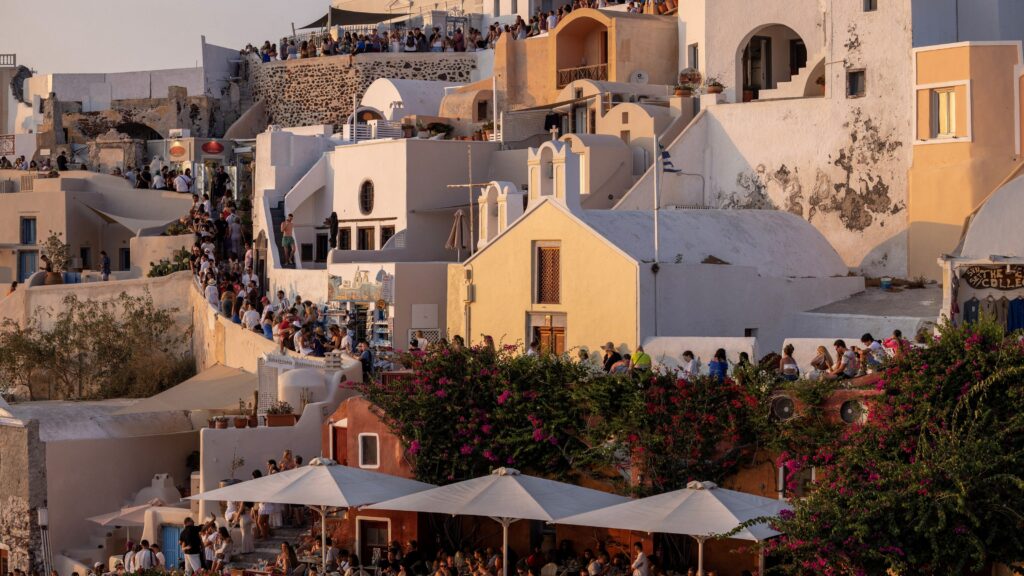

In other cases, the tax was considered less successful. This summer, Venice tried to limit the number of tourists by introducing a nominal fee equivalent to the price of a cappuccino, but this did little to discourage many tourists. Local residents, who did not notice a huge difference among the large number of tourists, believe the charges were a “mistake”.

Part of that may just be the newness of the concept. “Many destinations have yet to establish the right pricing strategy to make a real difference,” Abelson said.

But the effectiveness of these taxes is far from straightforward when it comes to tackling broader issues like climate change, said Marta Soligo, a professor and director of tourism research at the University of Nevada, Las Vegas’ Office of Economic Development.

“If we talk about climate change and overtourism, this is a global phenomenon and the tourism tax can be considered a so-called band-aid,” she said. Venice, a UNESCO World Heritage Site, has been flooded in recent years and is at risk of sinking.

For her, the issue of climate change impacts should be raised with local communities, by listening to indigenous knowledge about land management and by imposing taxes on big corporations like “polluters.” That’s what it means.

While it is not conclusive whether tourism taxes can significantly mitigate the effects of climate change and mass tourism, which Soligo says is the most harmful type of travel, the fact that tourism taxes are becoming more popular does. It’s a step in the right direction.

“If you think about global warming and over-tourism, you didn’t see much policy on this topic 10 years ago. So it’s good that we’re thinking about it and talking about it now.”

Contributor: Josh Rivera, USA TODAY