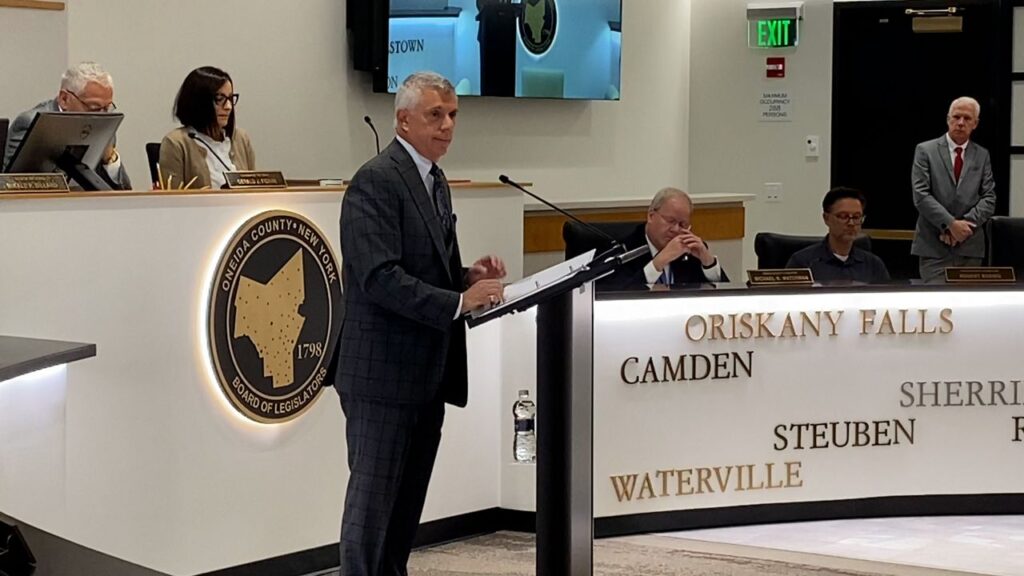

Oneida County Executive Anthony Picente proposed an alternative budget that would not include an increase in property taxes.

However, the proposal not to raise the levy was not without its challenges.

What you need to know: For the 12th year in a row, Oneida County has proposed a new budget with no property tax increases.

The proposed 2025 operating budget is $549,872,906, an increase of more than $20 million from 2024.

Oneida County Executive Anthony Picente said more than 90% of the proposal would go toward New York state-mandated costs.

Picente’s 2025 budget proposal includes more than $20 million in increases. Ninety percent of that comes from state-mandated fees, he said.

One cost to avoid is that hourly wages for appointed attorneys have more than doubled this year.

“They raised the hourly rate for our attorneys to $158 an hour, and that completely changed the scope of what we do,” Picente said.

Picente said the Civil Defense Agency needs to be reorganized to accommodate this increase.

County executives said salaries and benefits have increased by $30 million. He said all union contracts have been resolved.

The proposal takes into account rising prices and the effects of the EF-2 tornado in Rome, which caused more than $20 million in damage to the county in the short term.

Dozens of properties have been condemned and, viewed through fiscal eyes, “those properties will not be taxed unless they are rebuilt, and if they are not rebuilt, there will be a loss of income.”

Picente said the county commissioned a study to better understand the potential financial impact. The study, conducted by Camoin Associates, found an estimated “$13 million reduction in taxable property value to Oneida County, the City of Rome, and the Rome City School District.”

In the long term, Picente said, the study “projects a $28.6 million reduction in annual sales” and “a $13.5 million reduction in annual direct and indirect revenue, equivalent to 191 jobs.” He said it was found.

County executives also pointed to the need to reuse the county’s large hangar at Griffith International Airport. “The model we adopted there is not working as well as we hoped. We need to move forward in new ways,” he said.

Oneida Indian Nation revenue continues to contribute to Oneida County’s finances, an estimated $23 million in 2025, Picente said, but sales tax revenue remains “flat,” Picente cautioned. However, it is proposed not to raise property tax collections. It may go up this year, but it may go up next year.

“We’re still going to keep going. We’ve got to slow down a little bit,” he said.

The County Board of Legislators is scheduled to vote on the budget on Nov. 13.