It’s National Financial Planning Month, and experts are sharing their personal finance tips on Scripps News.

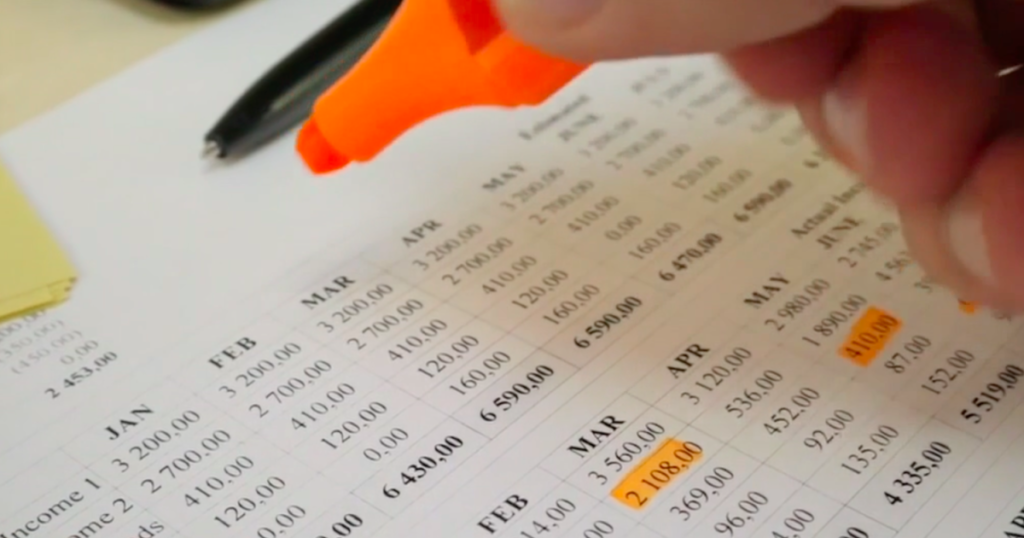

Automating your savings is a great way to make planning for big purchases easier. At least 50% of your salary should be devoted to daily expense necessities, and the remaining amount can be devoted to other areas of your personal finances other than entertainment and other necessities.

Some automatic savings programs can be helpful if you don’t work with a financial planner or advisor. And if you’re looking to get a loan, it’s best to watch interest rates like a hawk and make sure you understand all the numbers and what’s going on.

Jay Duffy is co-founder and managing partner of Frame Wealth Partners. He said to never let your emotions get the better of you when shopping. Leverage tested and proven financial knowledge from experts.

Related |The average American thinks they need $2.5 million to be wealthy in 2024

“Ultimately, the decision has to be made based on your financial goals and current cash flow situation,” Duffy told Scripps News.

He says weddings are a prime example of a distant event where you need to start saving very early. College costs and plans to have children are also prime examples.

Overall, the advice is clear. Always shop in line with your financial capabilities and goals, while always educating yourself with trusted expert advice from trusted sources.