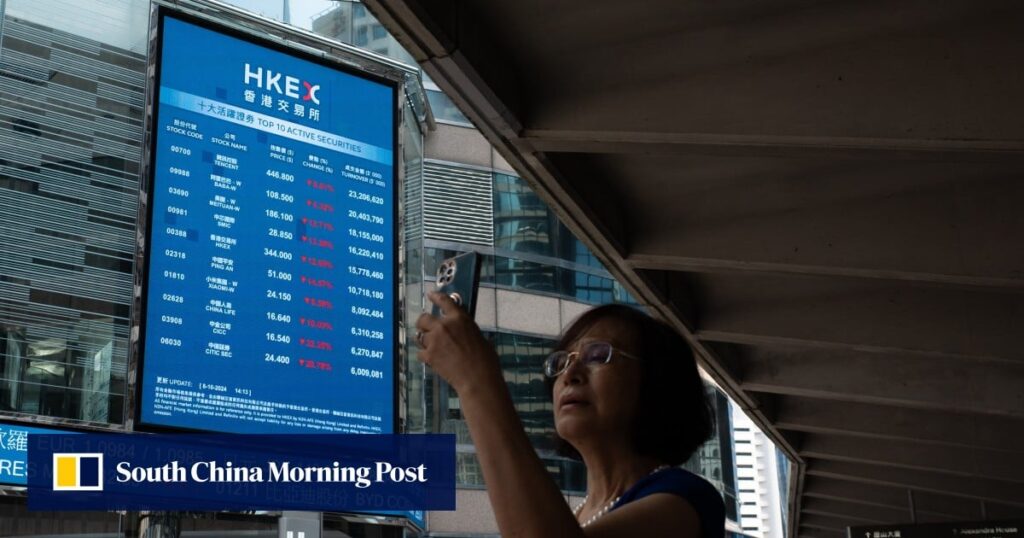

Hong Kong and Chinese stocks rose after the People’s Bank of China launched a US$70 billion lending facility to fund institutional buying and traders’ bets on more fiscal stimulus to boost growth. Both rebounded from the decline.

The Hang Seng Index is expected to rise 3.2% to 21,303.65 as of 10:39 a.m. local time, the first 11% decline in two days. The Hang Seng High-Tech Index rose 2.3%.

The CSI300 index rose 1.1%, rebounding from a 7.1% drop the previous day. The Shanghai Composite Index rose 1.2%.

Sentiment towards Hong Kong and mainland markets has stabilized since the People’s Bank of China launched a swap facility with an initial size of 500 billion yuan (US$70.7 billion). Under the program, eligible securities companies, mutual funds and insurance companies can exchange their holdings of bonds and exchange-traded funds as collateral for government bonds and central bank notes, the central bank said in a statement on Thursday. The project is scalable and applications from eligible institutions will be accepted immediately.

The swap facility is part of a financial instrument totaling 800 billion yuan announced by the People’s Bank of China last month to boost stock market liquidity. The package also includes a 300 billion yuan refinancing program to fund stock buybacks and capital increases by listed companies and major shareholders.

Investors will closely scrutinize Finance Minister Lan Foin’s press conference on Saturday. Expectations were high that Lang would announce or provide hints about much-publicized fiscal stimulus after world leaders signaled a sweeping shift to support economic growth. There is.