September 30, 2024, Donald Smith & Co (Trades, Portfolios). has acquired 901,485 shares of Genworth Financial Inc. (NYSE:GNW), making a significant addition to its investment portfolio. This transaction increases the company’s total holdings in Genworth stock to 25,015,294 shares, making it a significant investment move. The shares were purchased at a price of $6.85 per share, reflecting a strategic addition to the company’s substantial portfolio in the financial services sector.

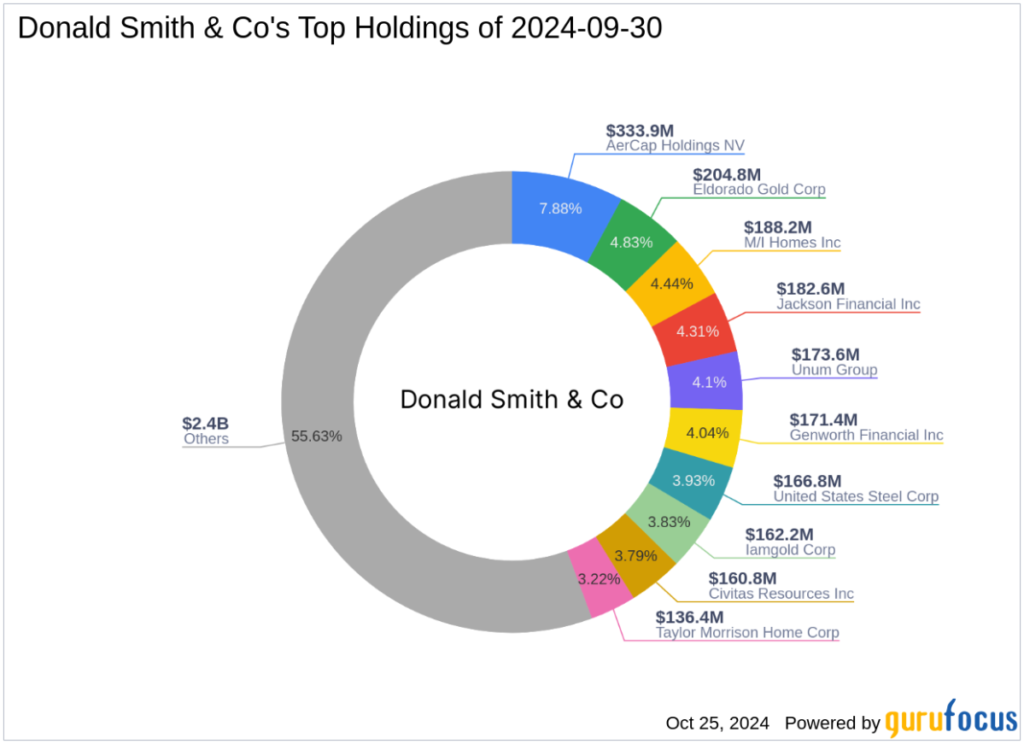

Donald Smith & Co (Trading, Portfolio), founded by Donald G. Smith. The company has been prominent in the investment community since 1980. The firm is known for its deep value investment philosophy, which focuses on unpopular companies that trade at a discount to their tangible book value. The firm’s approach is strictly bottom-up, looking for companies in the lowest decile of price/tangible book value with positive earnings prospects over the next two to four years. Donald Smith & Co (Trading, Portfolio). manages an equity portfolio worth approximately $4.24 billion, with top holdings in various sectors such as financial services and basic materials.

Donald Smith & Company increases capital in Genworth Financial, Inc.

Genworth Financial Inc. is a diversified insurance holding company headquartered in the United States. Since its IPO on May 25, 2004, the company has developed a strong portfolio of products including life insurance, mortgage insurance, and annuities. Genworth’s business is primarily categorized into Enact, life insurance, annuity insurance, and long-term care insurance, with the majority of its revenue derived from the long-term care segment. Despite the tough market, Genworth maintains a market capitalization of $2.91 billion.

Donald Smith & Company increases capital in Genworth Financial, Inc.

Recent acquisitions (transactions, portfolio) by Donald Smith & Co. increased its position in Genworth Financial Inc. by 3.74%, bringing its total shareholding in the company to 5.79%. This move not only underscores the company’s confidence in Genworth’s value, but also has a significant impact on the company’s portfolio, where Genworth currently represents 4.36% of its total investments.

Genworth stock is currently trading at $6.74, just below the trading price, reflecting a modest decline of 1.61% since purchase. The stock is moderately overvalued with a GF score of 66/100, indicating potential for future performance. The company’s financial strength and profitability are concerns, and it ranks low in indicators of growth and profitability.

story continues

Genworth operates in a highly competitive insurance industry and has struggled with financial metrics. The company’s interest coverage ratio and Altman Z-Score are low, indicating potential financial distress. But as the population ages, the company’s investment in long-term care insurance could be a strategic move to take advantage of growth in the sector.

Strategic Increase in Genworth Shares by Donald Smith & Co (Trades, Portfolio). It signals a positive outlook for the company’s recovery and long-term value. For Genworth, the investment represents increased investor confidence and could stabilize stock performance. For Donald Smith & Co (Trades, Portfolio), this move is in line with the firm’s deep value investing strategy and has the potential to generate significant returns as market conditions evolve.

This article created by GuruFocus is intended to provide general insight and is not intended as financial advice. Our commentary is based on historical data and analyst forecasts using an unbiased methodology and is not intended to serve as specific investment guidance. It does not constitute a recommendation to buy or sell stocks, and does not take into account your individual investment objectives or financial situation. Our objective is to provide fundamental data-driven analysis over time. Please note that our analysis may not incorporate the latest announcements or qualitative information from price-sensitive companies. GuruFocus has no position in the stocks mentioned herein.

This article first appeared on GuruFocus.